Novice buying a house worth noting five points, learn to invest to buy a house without trouble!

Today, there are more and more people buying houses in the UK. Today, I would like to talk about 5 issues that need to be paid attention to in the selection of housing investment. I hope it will be helpful to the investors who buy houses in the UK for the first time. 01 Make a reasonable budget A lot of people feel to buy a house is a troublesome thing, little imagine, want you to make reasonable budget initially only, control cost in oneself ability limits, buy a house is not a difficult! You need to fully consider their disposable funds, housing prices, loan repayment ability (monthly payments should generally be controlled at about 30%, so as not to reduce the quality of life), decoration costs, various taxes, property management fees and so on, so as to develop a reasonable budget.

In the UK, in addition to the monthly mortgage payment, there are other costs of buying a home, such as:

Attorney fees

The price of London property lawyer fees is about 1500+VAT (depending on the total price of the property and the specific hire of the lawyer), the lawyer will list a list for you in the quick delivery of the house, including stamp duty, land Office registration fees (200-920 pounds) and other fees.

Building insurance

Normally, when buying a new home, you can ask the developer for NHBC Buildmark's 10-year insurance policy.

In addition, you can choose to be insured freely according to the situation:

1) Buildings Insurance:

If you need a loan, you'll need both the insurance and NHBC Buildmark. Because Buildings Insurance protects Buildings in a way that NHBC Buildmark can't.

The length of the insurance is from the time you apply for the loan to the day you repay the loan. 2) Contents Insurance:

As the name suggests, this means protecting your home's finances, such as furniture, entertainment, kitchenware, appliances, jewelry, etc.

This can be chosen according to your needs.

Mortgage arrangement and valuation fees

The bank will assess the value of the property to see how much it can lend you.

The assessment fee varies from bank to bank and is typically between £150 - £1,500, which must be paid together with the loan application.

Of course, not everyone has to pay this fee, and some banks may not charge it, depending on the loan package.

Stamp duty

If it is purchased as an individual's first home, it can enjoy a lower stamp duty rate. For a £200,000 home, for example, the stamp duty on the purchase of a house is £1,500; Stamp duty on a £500,000 property, for example, is £15,000; If it is a person 2 sets and above housing, will produce housing total price of 3% additional stamp duty oh.

Government rent and property

Management fees are levied depending on the size of the property and can be around 0.5% to 1% of the total value of the property each year.

The annual cost of property in the UK, after tax on mortgage payments, can be between 12% and 20% of the annual rent, depending on the property.

02

Find the right developer

Once you've made your initial budget, it's time to start looking. As we all know, a house is just a matter of price, area, environment, management and so on.

But generally speaking, the first thing to look at the developers of the house. After all, a strong developer, not only quality, service guarantee, but also for the value of the house and forward-looking investment escort.

Unlike many houses in China that are delivered as "rough", British real estate is basically equipped with decoration and household appliances, so choosing a reliable developer is also the guarantee of aesthetics and taste.

03

Watch out for Property rights

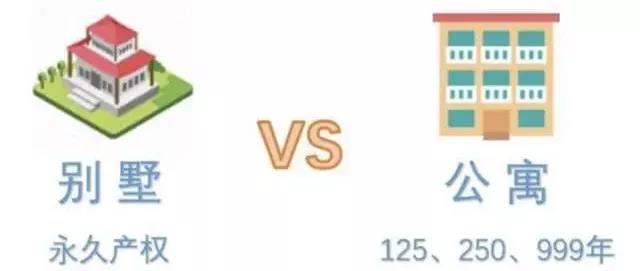

As we all know, China's civil housing property rights are generally 70 years, and belong to the right of use rather than ownership.

But if you have ever bought a house in the UK, you will probably see "life of ownership" on the property profile. Some say freehold, others say 125, 250 or even 999 years... Careful buyers may find that the former often corresponds to the type of property is "villa", the latter corresponds to "apartment".

Investors who want to buy a house in the UK should be aware of property rights. 04

Show the relevant documents to prove the source of the property

When buying a house in the UK, prove that the source of your property is not the proper place.

All purchases in the UK are done through solicitors, and all licensed solicitors are required by law to ensure that the money their clients are using to buy a house is legitimate, so they must "know their clients", ensure the legal status of private buyers, and review their articles of association and business. Private buyers are also required to produce a bank statement with a residence address.

It is normal commonly won't have what problem. The question above the account depends on how you pay for your property. You don't need to open an account if it's cash, but you need to reopen it if it's a loan.

05

Buy insurance in time

Finally, if you are successful in buying the house you like, please be sure to buy insurance for your new house! It covers both the building and its contents.

The lender will force you to take out building insurance. There are usually two kinds of insurance, replacement insurance and compensation insurance. Replacement insurance is "new for old", while compensation insurance is "old for old".